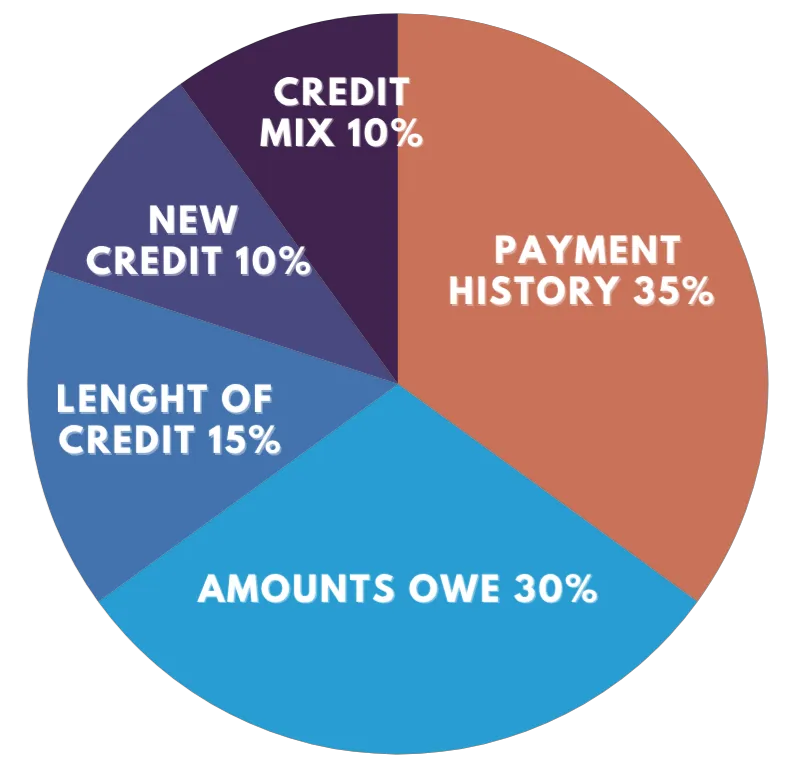

Your Credit Score Factors Analysis

FICO uses percentages to represent how important each category generally is, but the exact percentage breakdown used to determine your credit score will depend on your unique credit report. FICO considers scoring factors in the following order:

New Credit

10% of your score

Opening several new accounts in a short period can lower your score.

Length of History

15% of your score

Longer credit histories generally help boost your score.

Credit Mix

10% of your score

Having different types of credit can improve your score.

Payment History

35% of your score

Your record of paying bills on time has the largest impact on your credit score.

Credit Utilization

30% of your score

How much of your available credit you're using affects your score significantly.

GET STARTED WITH 2 SIMPLE STEPS

STEP 1

Sign Up with Smart Credit

STEP 2

Pay For Your Credit Analysis

MONTHLY PACKAGE

WHAT'S INCLUDED?

Credit Analysis

Unlimited Disputes

24/7 Client Portal Access

Email/Text Notifications

Credit Resources & Education

Credit Building

Money Back Guarantee if

No Deletions in 120 Days

BASIC PACKAGE

WHAT'S INCLUDED?

4 MONTHS

Credit Analysis

Unlimited Disputes

24/7 Client Portal Access

Email/Text Notifications

Credit Resources & Education

Credit Building

Money Back Guarantee if

No Deletions in 120 Days

ULTIMATE PACKAGE

WHAT'S INCLUDED?

6 MONTHS

Credit Analysis

Unlimited Disputes

24/7 Client Portal Access

Email/Text Notifications

Credit Resources & Education

Credit Building

Money Back Guarantee if

No Deletions in 120 Days

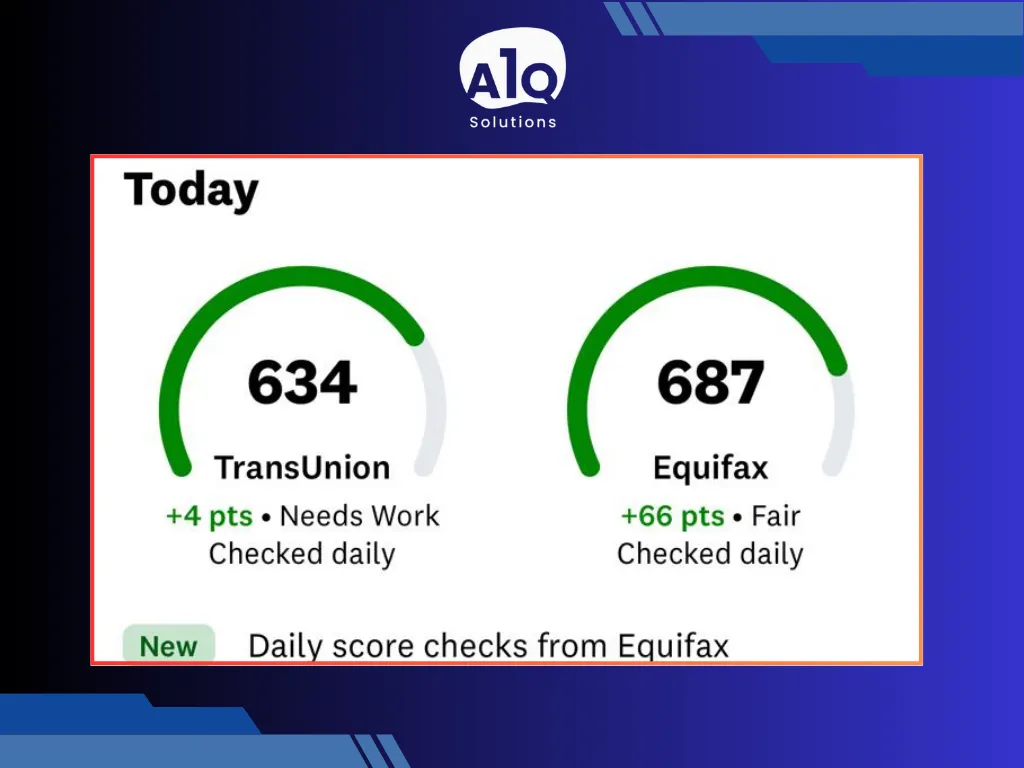

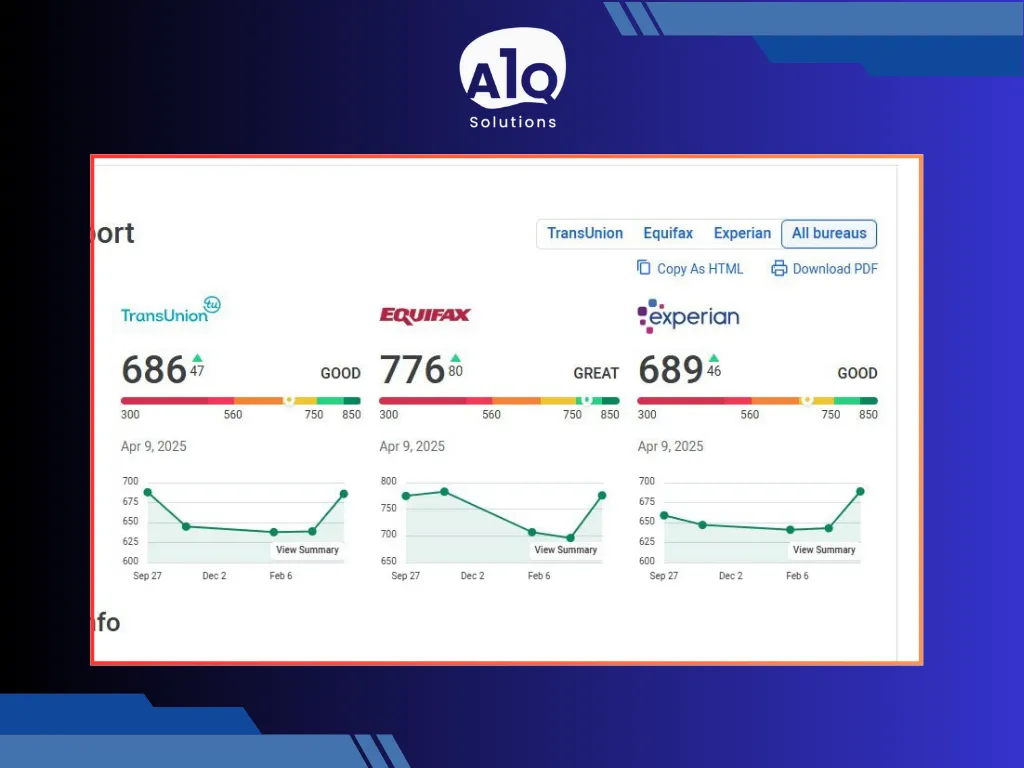

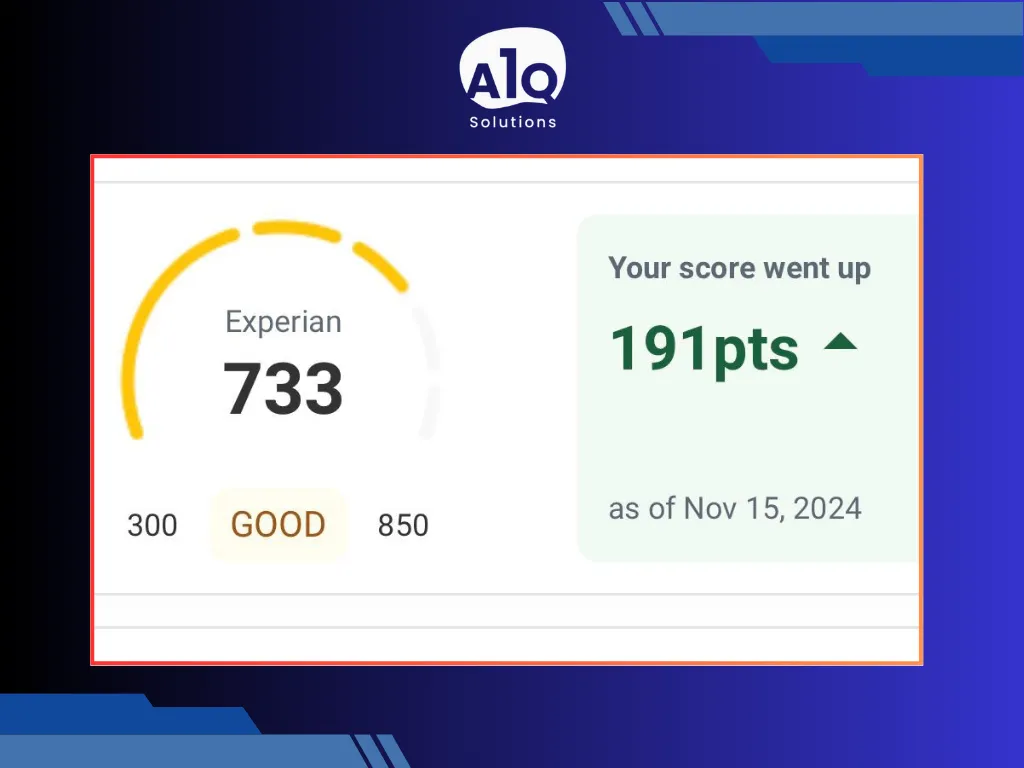

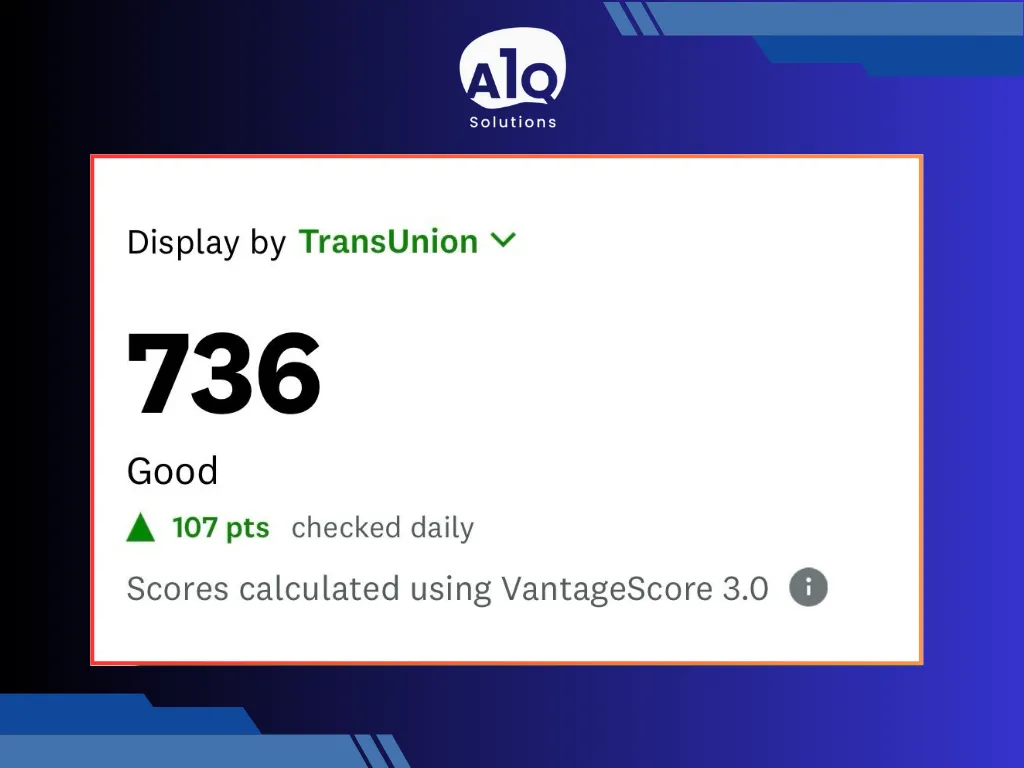

Real Clients - Real Results